GURUS EDUCATION

Teaching Youth Life Skills

Public Speaking, Debates, Personal Finance and Medikids classes (1-12 grade)

Personal Finance

The goal of these courses is to build financially responsible and smart youth. Students are taught about health,sex from 5th grade but there are no courses about financial literacy in our k-12 school curriculum. It is a very important skill to have. The financial decisions that we take make great impact in shaping our lives. These courses are ideal to sow seeds early on in raising financially responsible and smart youth.

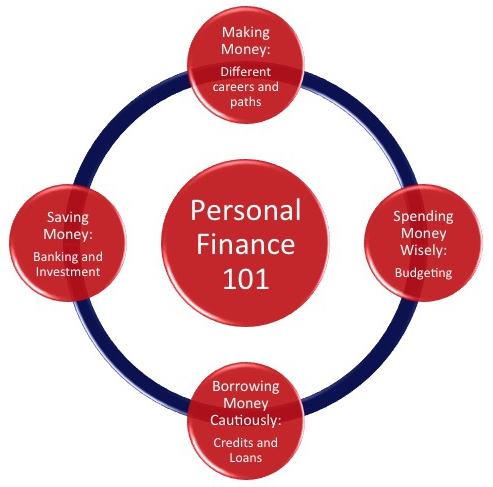

Personal Finance 101

(8 weeks one hour a week.)

This is the foundation course in the series that teaches students the essentials of financial literacy. It gives an overview of the personal finance skills and money management concepts. This course is designed to spark an interest in students to understand more about each of these streams by taking the advanced courses. These courses may inspire them to pursue careers in finance and business! It is highly recommended to take this course by all students.

Saving Money Wisely : Banking and Investments

(8 weeks one hour a week.)

In this course the students understand the value of saving wisely. What is the relationship between risk and return? This course teaches the different types of vehicles in which they can put their money to grow. They learn the risks and returns involved in each of the types of investments. They understand the strategies to use before selecting any method.

Is CD better for you or Stock market is the way to go?

Borrowing Money Cautiously: Credit and Loans

(8 weeks one hour a week.)

Credit/Loan/score Credit card is nothing but taking a loan. What are the responsibilities that come with different types of loans?This course teaches students the mystery and maze of credit and loans. The students often wonder about the plastic money. Who all are involved in a credit card transaction, how does credit card transaction take place. The students learn all about credit score and various types of loans and the responsibilities that come with them.

Making Money: Evaluating careers and the paths

(8 weeks one hour a week.)

In this course the students understand what are the different career options :Doing a job versus starting your business. What is it take to do business and what is franchising. What is the difference between net pay and gross pay and the taxation. This courses may inspire them to pursue careers in finance and business!

Spending Money Wisely: Budgeting and Tracking

(8 weeks one hour a week.)

Where does the money go? How can we track our expenses and analyze them? What is the concept of budgeting? The goal of this course is to teach students the key concepts in financial statements. They understand the difference between discretionary and non-discretionary expenses, the concept of true cost, ongoing expenses, wants and needs and much more. They students do assignments to create a budget and maintain cash flow journal throughout the class making it a fun way of learning such important concepts.